VC Dollars and Deals by Healthcare Sectors

Venture capital (VC) has become an instrumental force in driving innovation and growth across various industries, and healthcare is no exception. Within the article, we’ll cover venture capital within the healthcare sector, its significance, the healthcare investment landscape, the benefits it brings, and the types of healthcare companies that VCs actively invest in.

The Role of Venture Capital in Healthcare

Venture capital serves as a catalyst for progress in the healthcare industry. By providing funding and expertise to early-stage and high-potential companies, VCs help drive innovation, accelerate research and development, and bridge the gap between groundbreaking ideas and commercial success. With their financial resources and industry knowledge, venture capital firms empower healthcare entrepreneurs to transform their visions into tangible solutions that improve patient care, enhance medical outcomes, and reshape the healthcare landscape.

The Healthcare Investment Landscape

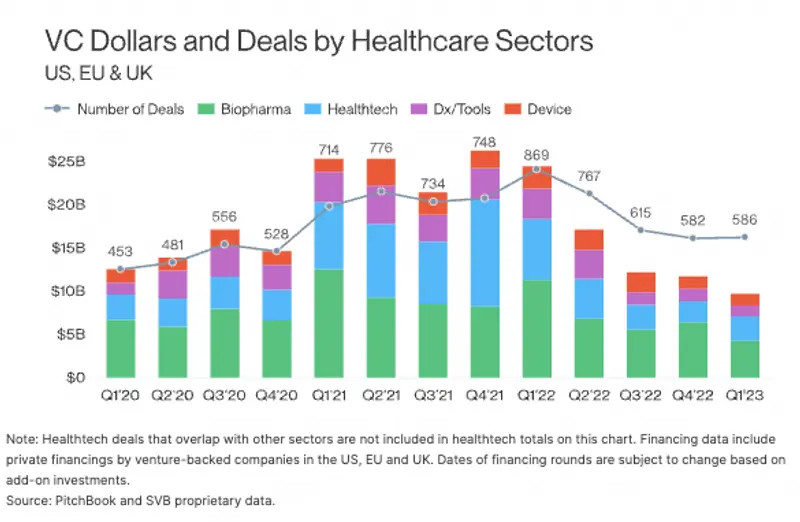

VC firms are actively seek opportunities in a wide range of healthcare sectors, including biotechnology, medical devices, healthcare IT, and healthcare services.

Despite a slight slowdown, venture capital funds managed to raise an impressive amount of nearly $22 billion in 2022, making it the second-largest fundraising year on record. The positive momentum continued into Q1 2023, with the fundraising pace accelerating slightly to $6.8 billion. Notably, early-stage investors showed a preference for seed and Series A investments, indicating their confidence in backing promising startups at the initial stages of their growth journey.

As venture capital funds still have a significant amount of capital yet to be deployed in the healthcare sector, it is expected that top companies will continue to attract investor interest. However, this interest is likely to come with investor-driven valuations, as investors seek to balance risk and returns in an increasingly competitive market. The abundance of available capital presents a unique opportunity for healthcare startups to secure the necessary funding to fuel their growth and innovation.

Although the overall investment pace experienced a slowdown in Q1, with investors navigating macro uncertainty and market downturns, they remained focused on supporting their promising later-stage portfolio companies. This support was evident through insider extensions and bridge rounds, allowing companies to bridge the funding gap and continue their growth trajectory.

Looking ahead to the second half of 2023, there is an expectation of an uptick in larger, outsider-led funding rounds. These rounds may see valuations being adjusted to better reflect market conditions, potentially resulting in down rounds or flat “engineered” rounds that include incentives for new investors.

“CVS is betting big on primary care. Here’s a breakdown of its 5 biggest deals of 2023.

CVS is aggressively investing in and acquiring digital health companies while competitors retrench. We dig into the pharmacy giant’s recent primary care moves.” Anand Sanwal, founder of CBInsights, Newsletter

Benefits of Venture Capital in Healthcare

Venture capital firms play a pivotal role in shaping the future of healthcare by providing critical funding, expertise, and strategic guidance.

Access to Capital

One of the primary advantages of venture capital in healthcare lies in its ability to bridge the funding gap for early-stage companies. Healthcare ventures often require substantial financial resources to advance research, conduct clinical trials, and navigate complex regulatory landscapes.

Expertise and Guidance

Beyond financial support, VC firms bring a wealth of industry knowledge and experience to the table. Seasoned investors offer strategic guidance, mentorship, and operational expertise to healthcare entrepreneurs. Their deep understanding of the sector helps startups refine their business models, overcome regulatory hurdles, and optimize their commercialization strategies. The invaluable insights and advice provided by venture capitalists significantly enhance the chances of success for healthcare ventures.

Validation and Credibility

Securing VC funding serves as a powerful validation for healthcare startups. The rigorous due diligence process conducted by venture capitalists not only validates the viability of the company’s products or services but also enhances its credibility in the eyes of other stakeholders. This validation opens doors to additional funding opportunities, attracts potential partners and customers, and positions the company as a trusted player in the industry. The stamp of approval from venture capitalists acts as a strong endorsement, driving confidence in the startup’s vision and mission.

Network and Partnerships

Venture capital firms possess extensive networks within the healthcare ecosystem, comprising key players such as healthcare providers, pharmaceutical companies, regulatory bodies, and industry experts. By partnering with venture capitalists, startups gain access to these invaluable networks, which can facilitate collaborations, strategic partnerships, and distribution channels. The connections offered by VCs are instrumental in accelerating market adoption, expanding reach, and tapping into new markets. The network effect of venture capital opens up a world of possibilities for healthcare startups to thrive and make a significant impact.

Long-Term Support and Sustainability

Unlike short-term investors or traditional lenders, venture capital firms typically take a long-term view when investing in healthcare companies. They are committed to supporting startups throughout their growth journey, providing follow-on funding rounds as needed. This long-term support ensures the sustainability and continuity of healthcare ventures, enabling them to focus on innovation, research, and achieving long-term objectives. The stability and backing of venture capitalists give healthcare startups the confidence and resources to navigate challenges and pursue ambitious goals.

This content is quoted from VISIBLE.

Disclaimer

The information on this website is intended to be for reference and general information purposes only.